Group structure

More information on the ownership of Cadent.

Investor relations and Debt investor relations are managed by Cadent's Corporate Treasury Team. The information contained within this area is generally for institutional investors and analysts interested in Cadent.

Cadent Gas Ltd, formerly known as National Grid Gas Distribution Ltd, (Cadent

or the Company

) is the largest regulated distributor of gas in the UK.

We own four of the eight regulated gas distribution networks. We own and operate over 131,000 kilometres of lower-pressure gas distribution mains, serving 11 million homes and businesses.

We work with various parties who are involved in the gas industry to ensure gas is available where and when it’s needed. Following production and importation, all gas in the UK passes through National Grid’s national transmission system, before entering the distribution networks. The distribution network providers, one of which is Cadent, are responsible for the safe and efficient transportation of the gas to the end consumer, on behalf of the chosen supplier.

Gas accounts for 66 per cent of the UK’s non-transport final energy consumption and is a critical component of the UK energy infrastructure. With a total regulated asset value of £9.7 billion as of March 2019 Cadent accounts for almost half of the industry's asset base. We are the second largest energy network operator in the UK, behind only National Grid Electricity Transmission, and all of our revenues are regulated under a price control framework monitored by Ofgem.

Investor relations are managed by Cadent's Corporate Treasury Team. The information contained within this area is generally for institutional investors and analysts interested in Cadent.

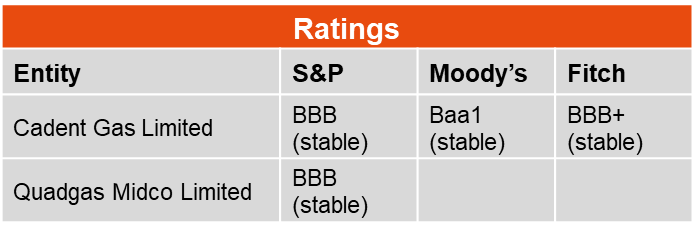

Cadent issues debt under Cadent Gas Ltd, Cadent Finance plc, Quadgas Finance plc and Quadgas Midco Limited. The existing debt programs are available here